What is non-invoice income? And how do you track it?

Small business owners are known for their enterprising abilities to earn income in diverse and creative ways. This means in addition to invoicing for work, there might be other income too, also referred to as non-invoice income.

Lots of irons in the fire keeps life interesting and prosperous—but they can also make tax time a headache.

Most service-based businesses send invoices to collect their payments, so when tax time rolls around it’s simple to run a report and find out how much income you brought in. But what if you have other sources of income, like cash payments, the sale of products, or sub-leasing? What is considered other income? Also, how do you track it?

We have all the answers to your burning non-invoiced income questions, including a helpful system to help you organize it all.

What is Other Income?

Any money you make through your business is considered income—even if you didn’t send an invoice to receive it. Here are some examples of non-invoiced income:

- Rent from a tenant

- Physical products you sell

- Interest accumulated in a business bank account

- Affiliate income

- Cash jobs

- The value of any goods or services received as payment instead of cash

Other income is income that’s the result of activities unrelated to the main service or product line of your business. For example, if you manufacture dog treats and earn rental income from sub-leasing unused office or manufacturing space this rental income would be classified as other income on your income statement. Other income that’s commonly categorized as other income is interest income, gains on the sale of assets, and gains from foreign exchange transactions. As guessed, things that fall into the other income category can vary quite a bit depending on the type of business you operate.

When it comes to your personal income tax return you need to report things like jury duty pay and lottery winnings as income, even though they fall outside of how you typically earn money. It’s a similar situation when it comes to your business.

A key thing to note is that other income is NOT considered revenue. Revenue is the result of money coming in as the result of the sale of products and services. These products and services are considered the core business and intent of your company. As mentioned, other income is considered earnings that fall outside the focused products and services of your business.

Intrigued? Diversifying your income is a great way to future-proof your business. Instead of relying on a single service and a handful of clients, having income from a number of different sources can help you secure success in the long term. You’ve just got to make sure you account for it all.

Why Is It Important to Track Other Income in Your Accounting Software?

A cash job here, an affiliate check there, and the occasional product in lieu of payment may not add up to a lot, but when it comes to doing your income taxes, every cent counts as taxable income. The same goes for regular rent checks or your side hustle on Etsy. As a small business owner, it’s up to you to track and report all of your self-employment income when you file your income tax.

If you don’t track it, your records will be inaccurate and income tax time will be … unpleasant. Not reporting your total income (including other income) can greatly impact your tax return and even lead to an audit. It’s important to have a system to manage your income, no matter where it comes from.

Another good reason to track non-invoiced income is to have a direct line of sight to where your income is coming from. Sometimes our impression of how much we’re making differs from reality. It’s helpful to be able to calculate how much that side gig contributes to your overall income. Maybe it’s not worth the trouble. Or maybe it’s more lucrative than you ever imagined.

How Do You Track Other Income in FreshBooks?

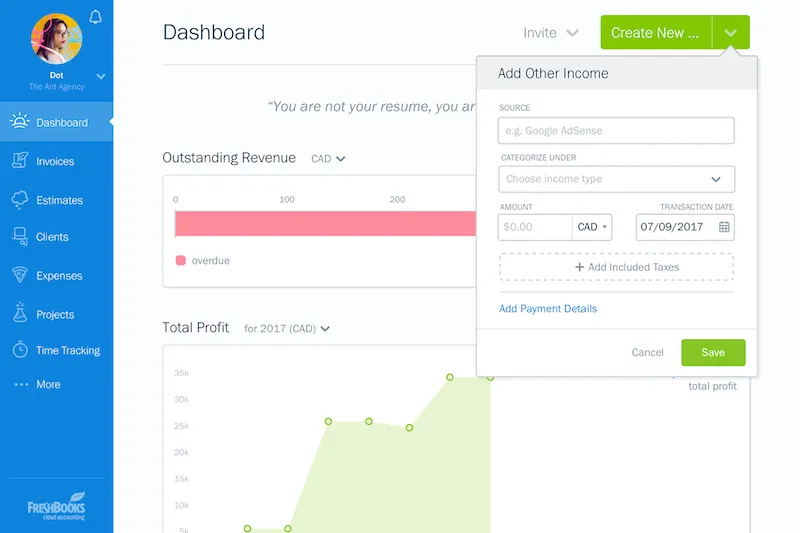

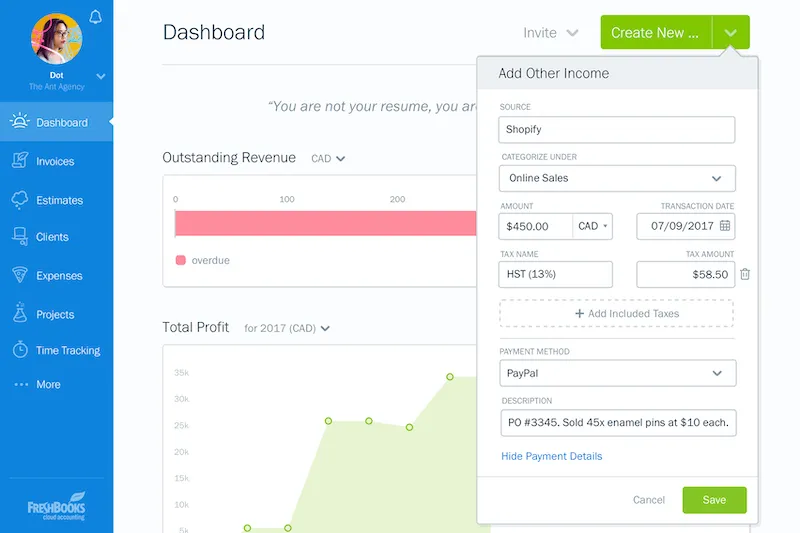

Whether you’re already a FreshBooks user or not, it’s simple and intuitive to add non-invoiced income.

- Start by logging in and clicking on Invoices

- Click on the Other Income sub-section that appears

- Next, click on the New Income Entry button

- Choose a Source (Hint: It helps to be as specific as possible so you can have a firm grasp on where your income is coming from)

- Select a Category for the income

- Finally, specify the Amount, Currency and Date

Just like with invoiced income, you’ll have the option to Add Included Taxes and specify Payment Details.

FreshBooks not only keeps track of all your entries but also color codes them for easy skimming. To access your list, click the More tab on the blue stripe from anywhere in your account then select Other Income. You’ll be brought to a page where you can search, review and even add new entries.

Good to know: An Other Income breakdown is available on your Dashboard so you can see at a glance where your money is coming from, and get insights that will help you direct your business anywhere you want it to be. Visit our FAQs here.

3 Main Types of Other Income You Might Want to Track

There are three main types of other income. The first is transactional other income, the second is contractual other income, and the third is accounting adjustments other income.

Transactional Other Income

Transactional other income includes:

- Loan interest

- Gains on the sale of assets

- The sale of marketable securities

- Gains on foreign exchange conversion

Loan Interest

Loan interest other income occurs when a company provides loans as a side income. These loans typically generate small amounts of income and don’t incur costs unless debtors default on the loans.

Gains on the Sale of Assets

A gain on the sale of an asset occurs when an asset is sold for more than its carrying amount. This is different from proceeds you’d receive from the sale of an asset, which is considered the total cash inflow. The gain is the difference that you’ve realized as profit and needs to be tracked as other income and is taxable income.

Sale of Marketable Securities

Gains on the sale of marketable securities happen when a company sells stock or bond holdings for more than their cost. For example, if a company buys a stock for $140 dollars in January and sells it for $150 in March, it must credit the $140 at-cost value from current assets and credit other income for $10, while also debiting cash for $150, since there was a receipt in that amount.

Essentially, you need to report the profit realized from the sale of stocks.

Gains on Foreign Exchange Conversion

Gains on foreign exchange conversion happen when you sell goods in a foreign currency and the exchange rate changes in favor of the foreign currency.

Basically, think of currency in terms of where the money is made vs the country you’re in. The foreign country in which you make money is what will impact your books.

If you sell something in Europe and earn EUR (a more valuable currency), you benefit from it changing back to USD. Inversely, when the EUR becomes less valuable, you lose money when converting back to USD. The profit on exchange rates is recorded as other income.

Contractual Other Income

Contractual other income includes:

- Fees for late payment from customers

- income from legal damages

Fees for Late Payment From Customers

If you’ve had the terms Net 15 or Net 30 days on an invoice then you know the value of invoice payment terms. They provide guidance for payment but also a place to indicate penalties for late payment if the situation arises. Additionally, contracts with set payment schedules and guidelines may also have payments baked into them for the protection of your business and the customer.

In the case of having to bill for a late payment fee, it must be recorded separately as other income for tax purposes. The reason for this is it was not planned and not part of your product or service offering, essentially it’s miscellaneous income.

Income from Legal Damages

It’s not uncommon for small business owners to have to go to court. The reasons can vary greatly depending on the type of business, but when a legal claim is successful and damages are paid, that income should be tracked as other income.

Adjustments Other Income

Adjustments other income includes:

- Gain from asset revaluation

- Unrealized gains on marketable securities

- Unrealized foreign exchange gains

Gain from Asset Revaluation

To get far too granular with information here: Under IFRS (International Financial Reporting Standards), but not under USGAAP (US Generally Accepted Accounting Principles), assets can be adjusted to increase their value. So in a nutshell, when the value of an asset outpaces its carrying amount, that difference needs to be recorded as other income.

This is a fairly complex assignment of income and unless you’re 100% comfortable, it’s advisable to talk to an accountant or bookkeeper about how things like fixed assets appreciate, are revalued, and appear on financial statements.

Unrealized Gains on Marketable Securities

Unrealized gains on marketable securities occur when the value of a security has increased in the market, but you haven’t sold the security at the close of accounting.

Accountants book the difference of the marketable security on the current asset account, and the counterparty account will be other income. The entry is debit marketable securities and credit other income. For this reason, it’s important to properly track your selling activities, including gains and things like taxable distributions (dividends, etc.)

Unrealized Gains on Foreign Exchange Conversion

As mentioned above, gains on foreign exchange conversion need to be accounted for on your tax return. Profiting from a change in exchange rate qualifies as taxable. Similarly, unrealized gains resulting from foreign exchange rate changes need to be tracked.

Conclusion: Yes, Track Other Income

When it comes to succeeding with your small business, there are no rules. You may have started out as a service provider, but want to expand into goods. Or maybe you want to diversify into a bunch of ways to earn income. At FreshBooks, we salute your ingenuity and are proud to help you account for it all, quickly and easily, whether it’s invoicing, payments, or tracking other income.

This post was updated in February 2022.

about the author

Heather Hudson has been a freelance writer for more than 17 years. As a small business owner, she understands the triumphs and challenges of life as an entrepreneur. And as a long-time FreshBooks customer, she’s always looking for ways to work smarter, not harder. You can learn more about her work at heatherhudson.ca.

9 Ways Accurate Accounting Can Increase Your Business’ Value

9 Ways Accurate Accounting Can Increase Your Business’ Value What Is RSS? 🧐

What Is RSS? 🧐 Conquering Common Money Mistakes

Conquering Common Money Mistakes