Give Canadian customers the flexibility and convenience of paying for recurring invoices directly from their bank account.

Congratulations, you’ve just won a client who happens to need your services every month. And whether you’re renting them equipment, or charging them a monthly consulting fee—the best way to make sure they get continuously billed is with a recurring invoice.

But when it comes time to get paid for that invoice, they may have forgotten it was being sent, or they don’t want to pay for a subscription on credit. Long story short: It’s frustrating chasing payments.

To help, FreshBooks has added Pre-Authorized Debits. Now, you can automatically debit a client’s bank account when a payment is due (with their permission, of course). It’s simple, easy, and convenient.

What Are Pre-Authorized Debits?

Pre-Authorized Debits (PADs) are an easy way to collect invoice payments on your client’s behalf. Just create a recurring invoice with PAD enabled, and when your client pays they can enter and save their bank details (one-time only). This allows you to then draw funds straight from their bank account, every time a recurring payment is due.

Who Can Use Pre-Authorized Debits?

Right now, this feature is only available to Canadian based users billing Canadian clients using Stripe payments.

How Do I Enable Pre-Authorized Debits?

To enable Pre-Authorized Debits:

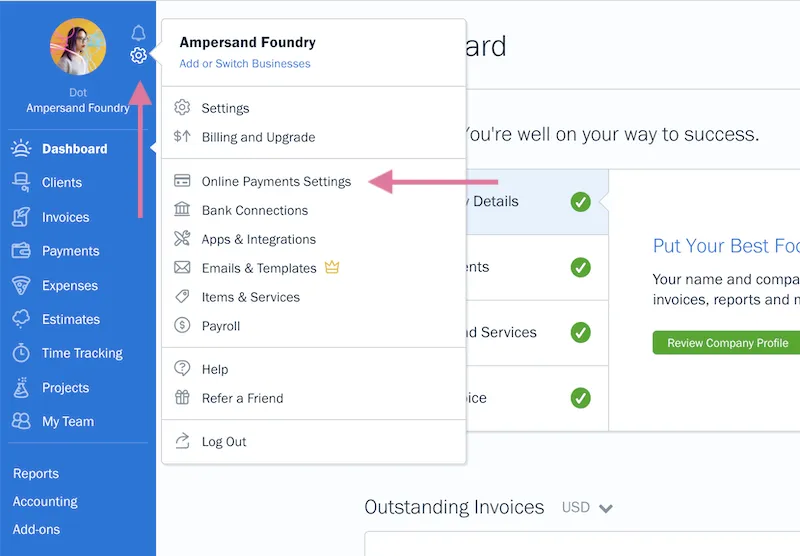

- Log into your FreshBooks account and click the gear icon in the top left corner.

- Click Online Payment Settings. Here’s what it looks like in-app:

- Scroll down to Other Ways To Get Paid and select Connect with Stripe:

- Verify your email, business information, and add a bank account.

- That’s it, PAD is now enabled!

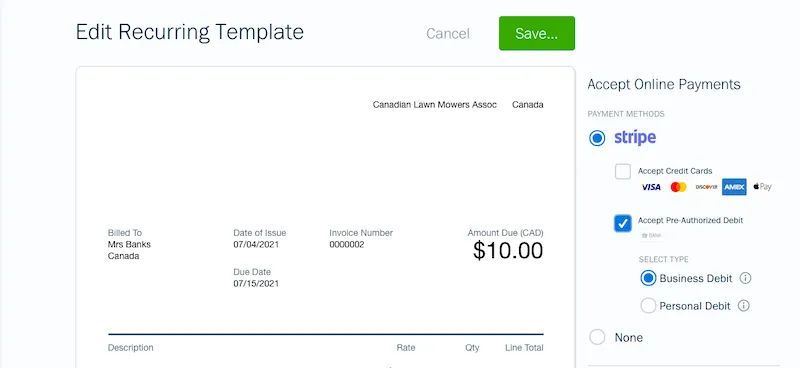

Now you’ll have the option to accept PAD on any Recurring Template:

- Click Accept Online Payments on the right of the invoice.

- Select Stripe and click the checkbox beside PAD.

- Choose whether it’s for Business or Personal Debit.

- Click Done.

Here’s what it looks like on an invoice:

Note: When your client receives their first invoice from the Recurring Template they’ll be asked a few questions to link their bank account and receive email confirmation from you for their records.

Why Should I Use Pre-Authorized Debits?

Instead of waiting for a customer to send a payment, Pre-Authorized Debits allow you to debit a customer’s bank account when the payment is due. The result? No more chasing payments. Other benefits include:

- Automatic payments mean less awkward follow-ups

- Perfect for recurring invoices (e.g., rent, subscriptions)

- Only a 1% fee + $0.40 per transaction

Need Help With Pre-Authorized Debits?

If you have any questions on how to get started with Pre-Authorized Debits, feel free to reach out here.

about the author

Dave is a Senior Copywriter currently working for FreshBooks, serving all the amazing businesses using the platform. When he’s not writing, Dave can likely be found binging Netflix alongside his dog Indy.