You can now accept Partial Payments on invoices to provide clients with added payment relief.

Do you have clients who prefer to pay in installments? Or maybe you have a client that needs to spread out their payments as they navigate a short-term hurdle like COVID-19? Then you know how hard it can be having to ask for a full invoice payment when they’re struggling to get paid themselves.

So to help provide your clients with added payment relief, you can now offer the option of Partial Payments. This new feature is available on both WePay & Stripe for all payment types.

What Are Partial Payments?

Partial Payments allow your clients to pay for a portion of an invoice’s full amount. This allows your clients to pay what they can afford today, so you can receive a chunk of your total owed amount to continue running your business.

How Do I Enable Partial Payments?

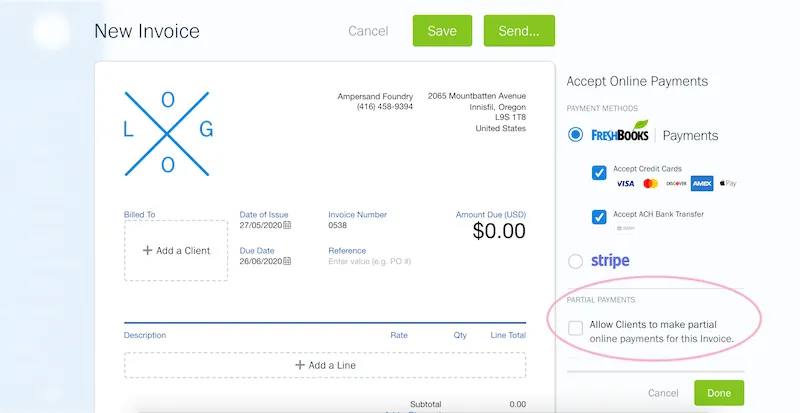

The option to accept Partial Payments is already live in your account. All you have to do is enable Online Payments, and you will see the Partial Payments option on all future invoices you send out to clients. Here’s what it looks like on an invoice:

What Will My Client See On An Invoice?

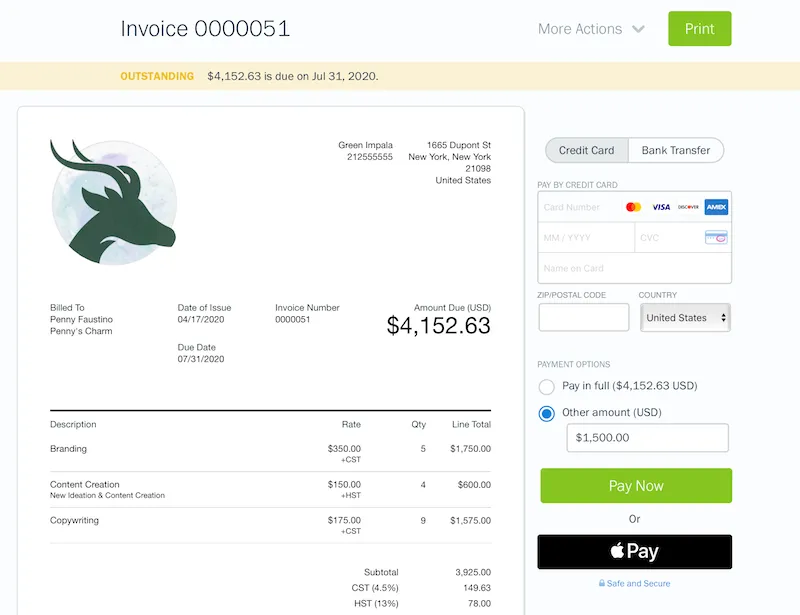

Your client will see the option to pay with an Other Amount, instead of the full invoice amount. Here’s what that looks like for them on an invoice:

Wait: How Are Partial Payments Different Than Payment Schedules?

Both Partial Payments and Payment Schedules allow you to receive payments in instalments. However, Partial Payments allow your clients to pay any amount they want, whereas Payment Schedules have a set amount due on set dates. Both are a smart way to ensure you get paid for your work as you go, without having to use multiple invoices.

Why Should I Use Partial Payments?

Running a small business is all about nurturing client relationships. Partial Payments is a great way to put trust in your clients to pay what they can today, knowing that they will pay you the rest when they’re back on their feet.

What If My Client Never Pays the Full Amount?

It happens… Unforeseen circumstances can mean a client has to fold their business, leaving you in the dark on payments. The best way to ensure everything is accurately reflected in your reports, is to add a Bad Debt line item on the invoice, with a negative amount equal to what you’re owed. This will zero the invoice out and ensure you can keep accurate records.

Need Help Getting Started?

Payments are one of the most important pieces to running a successful business. That’s why a team of Support Rockstars is ready to help you out if you have any questions on Partial Payments. Contact them here.

about the author

Dave is a Senior Copywriter currently working for FreshBooks, serving all the amazing businesses using the platform. When he’s not writing, Dave can likely be found binging Netflix alongside his dog Indy.