FreshBooks has partnered with Fundbox to help small business owners (just like you) solve short-term cash flow problems by providing payment advances for unpaid invoices within 24–48 hours.

One of the most significant challenges of running a small business is managing cash flow. Regardless of how well your business might be doing, the 30- to 90-day wait to get paid can result in stressful cash flow gaps that need to be bridged right away.

Whether to pay your staff and contractors or buy supplies for your next job, you need to keep your business running while you wait to get paid. But securing money through traditional means (like banks & other financial institutions) isn’t easy. If you’re lucky enough to get approved for credit, the funds usually take forever to reach your bank account.

- Say Hello to Steady Cash Flow With Advances in FreshBooks

- How Does it Work?

- How Much Does it Cost?

- Repay Early and Waive All Remaining Fees

- How to Connect to Fundbox

- How to Get an Advance on an Unpaid Invoice

- How to Repay Early

- Get Started With Fundbox and FreshBooks

- Use Invoice Payment Terms to Improve Cashflow

- What Are Invoice Payment Terms?

- Improving Invoice Payment Terms

- Benefits of Invoicing Software

Say Hello to Steady Cash Flow With Advances in FreshBooks

FreshBooks has partnered with Fundbox to help small business owners (just like you) solve short-term cash flow problems by providing payment advances for unpaid invoices within 24–48 hours. Getting an advance can help you bridge the cash flow gap, so you can pay your employees and contractors on time and avoid awkward payment conversations with your clients.

How Does it Work?

You can connect your account to Fundbox directly in FreshBooks and receive the details of your credit limit within 24 hours. If your account is approved for funding, you’ll see a “Get an Advance” link on your unpaid invoices that are less than 90 days old.

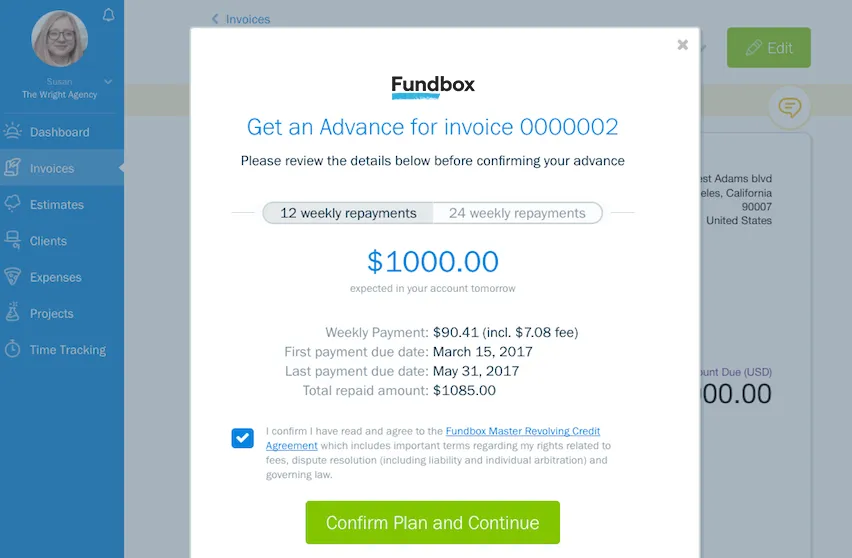

Before making any commitments, you see how much you get, how much you have to repay (including fees), and finally, your repayment schedule. Confirm the advance, and funds will be sent directly to your bank account within 2 business days.

How Much Does it Cost?

Signing up for Fundbox is free—you only pay a fee when you choose to receive an advance on an unpaid invoice.

Here’s how it works: When you take an advance, Fundbox will add a fee on top of the invoice value. The fee for using $1,000 of credit and repaying over 12 weeks ranges from approximately $48 to $84. Fees may vary, but you’ll always know them before committing to anything. After receiving the invoice amount upfront, you then pay back the invoice amount plus fees, over 12 or 24 equal weekly payments—that’s it—no hidden costs or surprises.

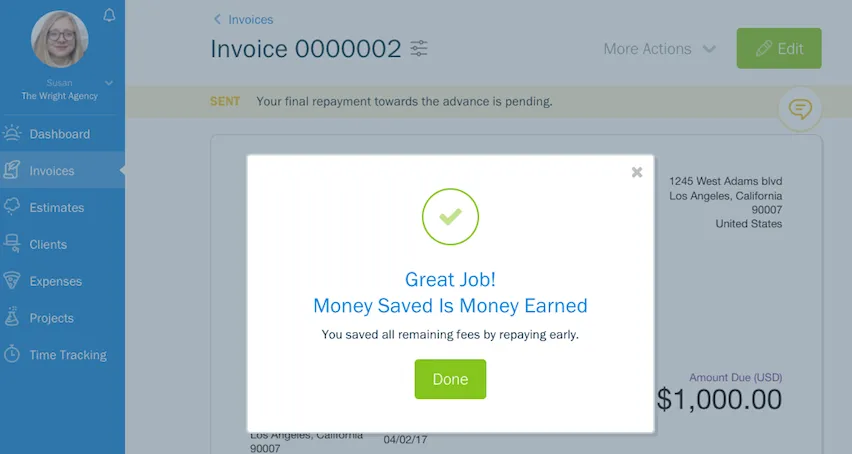

Repay Early and Waive All Remaining Fees

If your client pays you sooner than expected or has the funds to repay early, you can do so in your FreshBooks account to save on fees. Unlike other lending solutions that penalize you for early repayment, Fundbox rewards you by waiving all remaining fees on your advance.

How to Connect to Fundbox

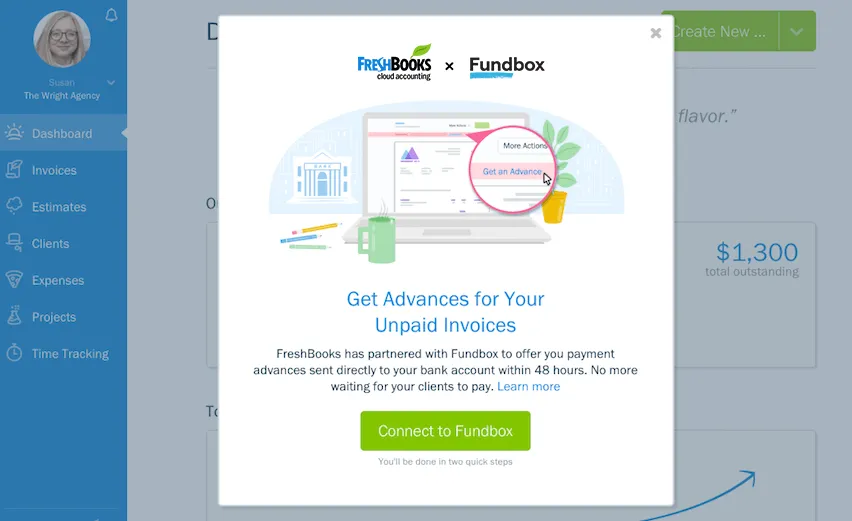

When you log into your FreshBooks account, you’ll see this notification:

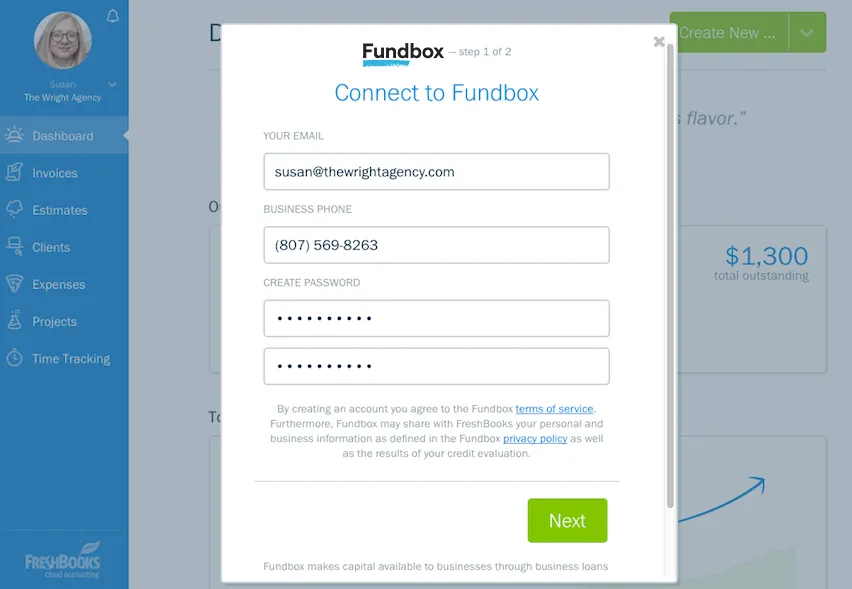

Click on the “Connect to Fundbox” button, and if you don’t have a Fundbox account, you’ll be automatically prompted to create one directly in FreshBooks.

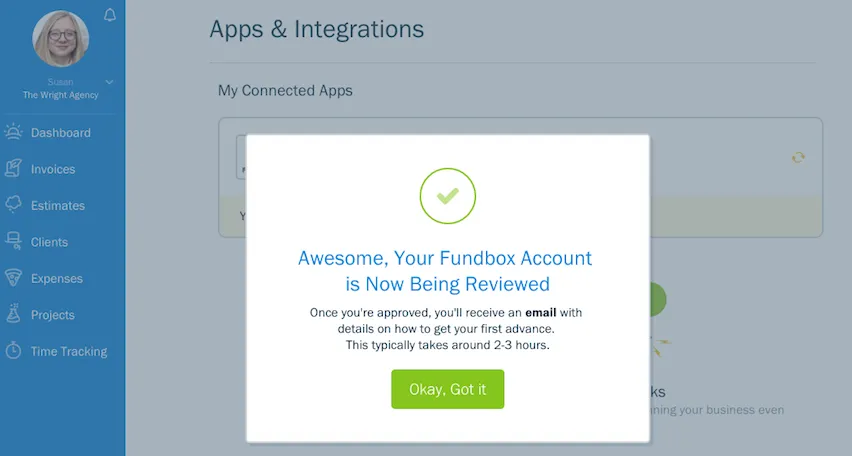

Once you’ve confirmed your details, Fundbox will analyze your accounting data to determine whether they’re able to approve your business for funding. This review process usually takes around 2–3 hours, so go for a walk or start working on that next big project while Fundbox works its magic.

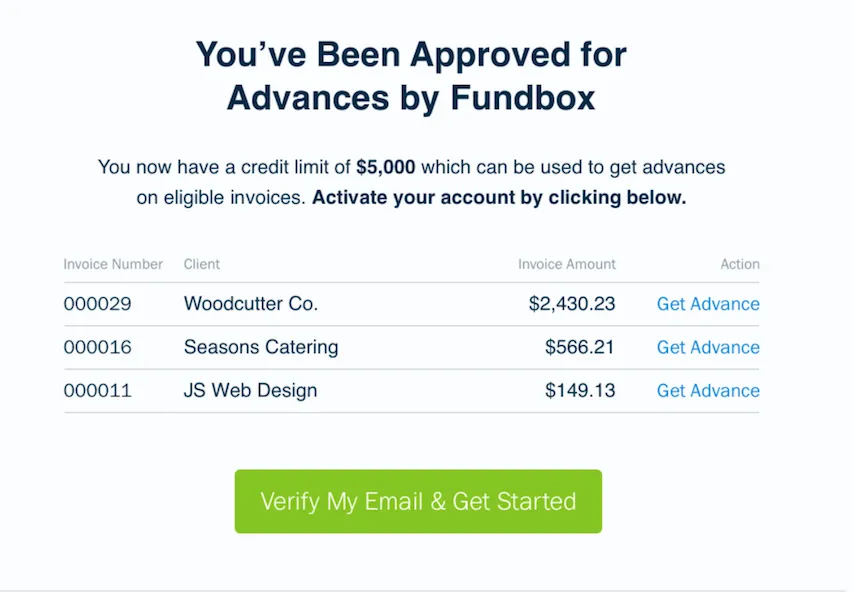

Once your account has been reviewed, you’ll receive an email notification with the details of your credit limit, as well as the invoices eligible for an advance. For account activation by Fundbox, you’ll need to click on the green button in the email to verify your email address.

How to Get an Advance on an Unpaid Invoice

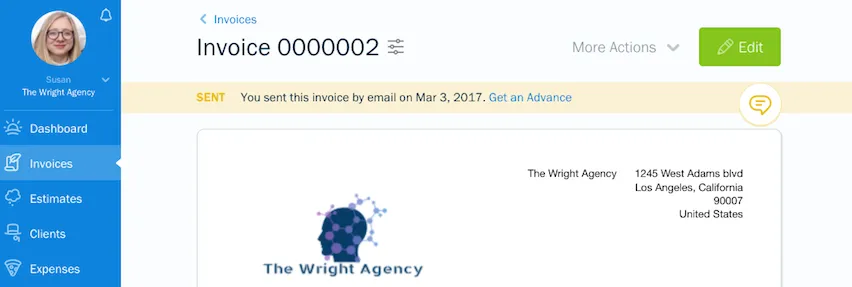

If you’re ready to receive an advance, head over to the Invoices tab in your FreshBooks account and select an unpaid invoice. If the invoice is eligible for an advance, you’ll see the “Get an Advance” link in the status bar.

Click the “Get an Advance” link to review the full details of your advance. Before you make any commitments, you’ll see how much you’ll receive, how much you’ll have to repay (including fees), and, finally, your repayment schedule. Select your preferred repayment plan and click on the green button to confirm the advance.

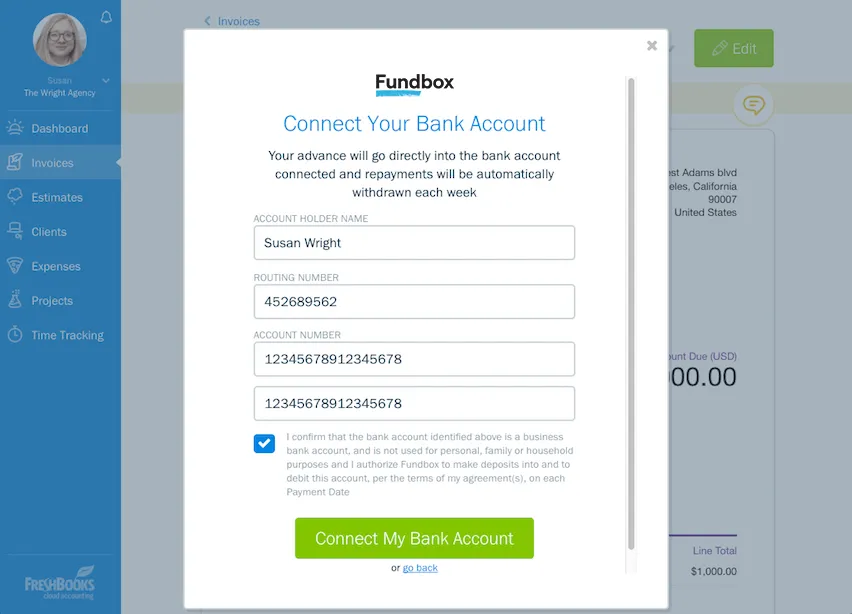

If it’s the first time you’re receiving an advance, you’ll need to enter your banking details. Fundbox will use the bank account you enter to deposit your advance but also will automatically withdraw your weekly repayments:

Once you’ve confirmed your bank details, you’re done! Your advance will typically arrive the next business day but could take up to two business days, depending on your bank.

How to Repay Early

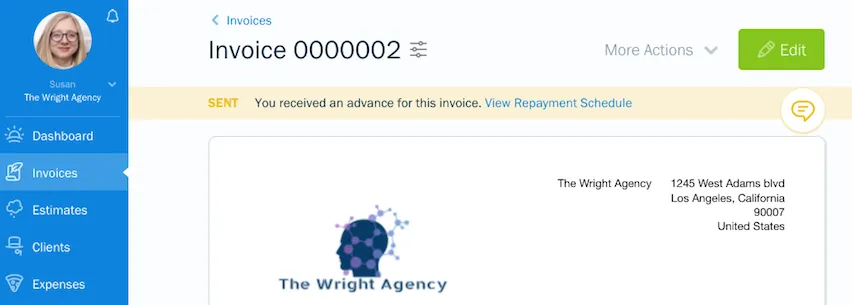

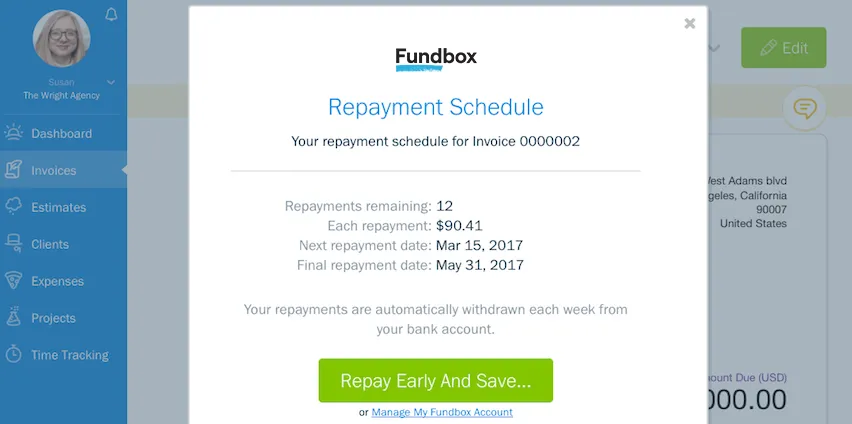

Select the invoice for which you received an advance and click the “View Repayment Schedule” link in the status bar:

You’ll see how many weekly repayments you have left and the upcoming withdrawal date. Click on the “Repay Early and Save” button to view your early repayment details.

You’ll be shown exactly when and how much will be repaid from your bank account. Plus, you’ll also be able to see how much you’ll save.

Once you’ve confirmed by clicking on the “Pay Remainder” button, you’re done!

Get Started With Fundbox and FreshBooks

Connect to Fundbox for invoice financing to find out how much credit you’re eligible for—you won’t have to pay a penny in fees until you actually take out an advance on an outstanding invoice.

Here’s a link to the integration details page for more information.

Use Invoice Payment Terms to Improve Cashflow

On top of using Fundbox and invoice financing to solve short-term cash flow issues, there are other measures you can take to improve your company’s cash flow. Invoice financing is a great start, but it can only take you so far in dealing with unpaid invoices.

One of the best ways to deal with outstanding invoices starts with your invoice payment terms.

What Are Invoice Payment Terms?

Sorry, it’s easy to forget that this may be a new concept as it’s an important part of invoicing with FreshBooks. Invoice payment terms are located at the bottom of your invoices. It’s that spot that allows you to input some notes or details about your payment process or how quickly you want customer payment.

Payment terms help you avoid unpaid invoices by specifying:

- A timeframe, due date, payment deadline, or schedule of payment for your services

- Interest charges or late fees for late-payments

- How you collect payments and if you offer multiple payment options (direct deposit, credit cards, bank transfer, cash, cheque, etc.)

Payment terms help your customers understand their next steps when receiving an invoice from you or your company. It details how they should go about paying the invoice, and by making that process clear and easy, you’ll get paid faster.

While there are many phrases you could include in your terms for payment, some phrases aren’t easily understood by everyone.

Terms like “10 net 30” and “CIA” might make sense to you, but if your clients are thinking “Central Intelligence Agency” instead of “Cash in Advance,” they might not pay on time.

Improving Invoice Payment Terms

If you already have invoice payment terms detailed at the bottom of your invoices, you might think you have it all covered, but consider the following. How many past due invoices do you currently have? Have you used a debt collector to help you manage overdue invoices? Have you ever been to small claims court for an overdue invoice? Revisiting them for each new client or at regular intervals doesn’t hurt and can help you avoid painful collection scenarios.

Here are some things that can help you get paid in a timely manner:

- Keep invoice payment terms show, sweet and concise

- Be polite by including please and thank you and any other appropriate salutations

- Be realistic about timely payments and when you actually need an invoice paid by

- Be flexible and allow for things like partial payment or a payment plan if it makes sense for the client and the client relationship

- The late payment process should be clearly defined to include penalties for any past due invoice

Here’s a data-packed article with all the specifics to help you make your invoice payments terms work their hardest for you.

Benefits of Invoicing Software

Improving cash flow is tough, but invoice financing is only part of the solution. Invoicing software like FreshBooks helps collect unpaid invoices and avoid professional debt collector services. Features like online payments, recurring invoices, automated invoice reminders, retainers, checkout links, and more can make it so much easier for clients to pay and for you to receive payment faster.

about the author

If your books are a mess and you’re looking for an easy fix, FreshBooks is that solution. It’s software that makes billing, accounting, and client service easy for business owners. Get automated invoicing and payments to save you 550+ hours/year, reports that tell you how things are going, and access to time-saving tools for your whole team. Cool right? We’ve got a website with all the details, a Twitter account that’s pretty sweet, and a Youtube channel packed with awesome videos.