If you’re new to the business world, you may not realize all of the overlooked costs–both small and large–that go into operations.

Anyone who owns a business knows you need to spend money first in order to make money later. But if you’re new to the business world, you may not realize all of the overlooked costs–both small and large–that go into operations.

The Rundown of Expenses

Incorporation Costs

Incorporating your business has definite advantages, like creating tax benefits and shielding your personal assets from liability. According to Entrepreneur, hiring a lawyer to help you incorporate can cost you between $500–$1,000, in addition to your jurisdiction’s filing costs and periodic mandatory filings.

Insurance

Depending on the nature of your business, you may need Liability Insurance or Errors and Omissions Insurance to protect yourself against potential lawsuits. As a business owner, you may also want to purchase disability insurance in case a debilitating illness or injury leaves you unable to work.

Benefits

If you have staff, you’ll need to budget for employee benefits, like health insurance, paid time off, and retirement savings plans. Even if you’re a sole proprietor, you’ll still need to pay for your own health insurance and retirement savings.

Founder Agreements

If you’re going into a business partnership, especially with a roommate, friend, or romantic partner, treating the arrangement casually can backfire. It’s in both of your interests to hire a lawyer to draft a founder agreement and set expectations. This can set you back hundreds of dollars depending on the complexity of your situation.

Trademarking

Filing trademark registration can help protect aspects of your brand and prevent others from copying yours. The US Patent and Trademark Office (USPTO) has a detailed primer on the benefits of federal trademark registration, as well as the costs involved. USPTO has several different types of trademarks and the application fees will cost you several hundred dollars. Plus hiring a trademark lawyer to help you navigate the process will obviously increase the cost.

Taxes

We all know that death and taxes are two of life’s few certainties, but many business owners fail to set aside extra money for taxes, which can have catastrophic consequences. In the US, depending on your situation and business structure, you may be required to file quarterly estimated taxes. Also, your tax rate may be higher as a business owner than as an employee due to the self-employment tax. However, you may able to offset this with business deductions.

Credit Card Fees

If you accept credit card payments, factor in the cost of credit card processing, also called interchange fees. This is typically a per-transaction flat fee and a small percentage of each transaction.

Office Supplies

A few boxes of pens or reams of printer paper may not seem like much, but those little costs do add up over time. Try to maintain digital files whenever possible to avoid printing—it’s economically and environmentally smart!

Office Overhead

As a growing business, you can expect to outgrow your home office, which means you’ll need to consider renting office space. Depending on your location and the amount of space you need, it can set you back hundreds of dollars (or more) per month.

Memberships and Subscriptions

Joining your local Chamber of Commerce or BNI group can help grow your business, but those membership fees aren’t cheap. One networking mistake business owners make is focusing on groups with professionals exactly like them. Commiserating and swapping stories from the trenches can be helpful, but you should also be present where your high funnel audience is, so you’re not networking in a vacuum.

IT Support and Web Development

Nowadays, customers expect businesses to have an online presence so they can read company information anytime, day or night. In addition to paying the initial cost of website set-up, you’ll have ongoing costs such as tech support, web hosting, and domain renewal to keep your website running.

Marketing

The saying, “build it and they will come” doesn’t always work. Today, you need strong marketing to attract new prospects and a strategy to convert those prospects into paying customers. Depending on the nature of your business, this might mean printing and distributing flyers, creating email and social campaigns, or hiring a publicist to help create buzz.

Strategies to Stay In-Check

Overlooked costs—for a lack of a better word—could cost you. But there are small ways you can ensure you make smart moves and stay on track.

Ruthlessly Prioritize

Find what’s important to your business growth potential and start there. For instance, you won’t have time to keep up with every industry organization or participate in every social media channel, so prioritize where you want to spend your money and energy. If you’re not getting a good return on investment for a certain expense, it might be time to cut the cord or look at ways to economize.

Consider DIY Tools

A slew of free and inexpensive tools allows business owners to market themselves and set up a website without paying for outside help. Hootsuite, SquareSpace, Wix, and MailChimp are just a few of these tools that can help you get started. At some point, though, your business will likely grow to the point where you need a more robust, customized website or marketing strategies or you don’t have time to focus on marketing or website updates. At that point, it probably makes sense to outsource those tasks.

Cost-Effectively Upgrade Your Home Office

Perhaps setting up your laptop in a corner of your living room no longer works for your fledgling business. But if you can give your guest room a makeover with the proper equipment to function like a home office, you may be able to put off renting office space until later.

That said, you also don’t want to skimp on any expenses that will help keep your business on the legal straight and narrow. For instance, rather than relying on Google for legal advice, hire a specialized attorney to advise you on your specific situation. Otherwise, this can get you into hot water and may wind up costing you more money in the long run.

Using small business tools to help keep your ducks in a row should also be on your list of must-haves. Disorganized bookkeeping and invoicing can result in tax issues, delayed receivables, and other problems that distract you from running and growing your business. After all, most business owners would rather spend their time chatting with customers instead of dealing with the financial or legal headaches which could have been avoided from the beginning.

Log Expenses Effortlessly with FreshBooks

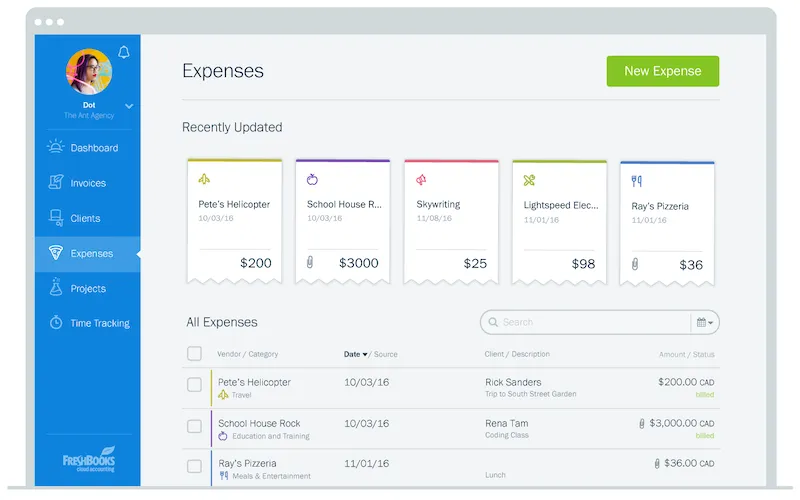

Capturing and tracking expenses is a crucial part of running your business. But it can also become an annoying chore. That’s why FreshBooks takes the pain out of capturing every expense, big or small.

Within the Expenses feature, you can:

- Take the pain out of logging expenses by connecting your bank account or credit card and having your expenses automatically recorded for you every day, without needing to lift a finger.

- Access all your information, together in one place. The improved dashboard highlights your most recent expenses and is even color-coded so you can see how much you’re spending at-a-glance.

- Have the flexibility you need. You can create expenses in multiple currencies and invoice your expenses back to your client. You can even add a markup to help ensure you stay profitable.

This is an archived post from the FreshBooks Blog and was originally published in July 2016.

about the author

Freelance journalist Susan Johnston Taylor covers entrepreneurship, small business, and lifestyle for publications including The Boston Globe, The Wall Street Journal, Entrepreneur, and FastCompany.com. Follow her on Twitter.