Want to customize your chart of accounts? Follow these tips to set up the best account structure for your business.

Your chart of accounts outlines all the accounts for your business. It is a bird’s-eye view of what you own, what you owe, how much your business makes, your costs, and the value of the business (equity). From the data in your chart of accounts (CoA), you can run almost any financial report you need.

Creating a chart of accounts is easy if you have accounting software like FreshBooks. There, the chart of accounts is created automatically for you, using a default CoA structure that works just fine for many businesses.

But a more tailored CoA can benefit some businesses.

- Why Customize Your Chart of Accounts?

- Start With the Basic Chart of Accounts

- Default CoA Accounts

- Advantages of Adding Custom Accounts

- 8 Best Practices for Customizing Your Chart of Accounts

- Custom Chart of Accounts Example

- Consider Getting Help From an Accountant or Bookkeeper

- The Easiest Way to Customize Your CoA

Why Customize Your Chart of Accounts?

The more complex your business, the more likely you’ll want to tailor your chart of accounts to your needs.

Roofing Done Right is a rapidly growing business with employees and overhead costs. Its accounts include:

- Wages for multiple employees

- Cost of goods sold (COGS)

- General overheads

- Employee costs

- Long-term assets (machinery, equipment, vehicles)

- Liabilities (workers’ compensation, withholding taxes, operating loan)

- Equity (Owner’s or Shareholder(s)’ contribution)

In contrast, Max’s Web Design is just fine with a simple CoA. Max is a sole proprietor with no employees, little overhead, and fewer than 10 clients. Max’s transaction types and accounts are limited to those found in a typical CoA and include:

- Revenue

- Expenses (internet, rent, supplies)

- Assets (computer,furniture)

- Self-employment taxes

But even businesses like Max’s may want more from their chart of accounts as they scale. It might be time to customize your CoA if you want to add more revenue streams, hire some contractors, or want more detail in your financial reports.

Start With the Basic Chart of Accounts

All businesses should begin with a good foundation: a standard chart of accounts.

FreshBooks and other accounting software packages have a default CoA organized according to GAAP in the U.S.

Every chart of accounts has 5 main account types:

- Asset Accounts

- Liability Accounts

- Equity Accounts

- Revenue Accounts

- Expense Accounts

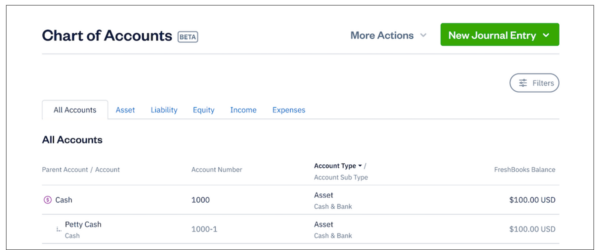

Within those 5 account types are account sub-types, Parent accounts, and sub-accounts. Here is an example from the FreshBooks default Chart of Accounts.

In this example, the account type is “Asset,” the account sub-type is “Cash & Bank,” and “Petty Cash” is a sub-account of the “Cash” parent account.

Default CoA Accounts

The FreshBooks Chart of Accounts includes some of the most commonly used accounts for small businesses:

As your business grows, you’ll likely need more accounts that are specific to your business. Large, complex businesses can have thousands of accounts.

Advantages of Adding Custom Accounts

Here are some of the benefits of tailoring your accounts to your business:

- You can categorize financial information in a way that makes sense for your business, which gives you more precise data about (and better insight into) your income, expenses, capital expenditures, liabilities, owner’s equity, etc.

- More precise data means more precise financial reporting and easier tax filing.

- It can make tax compliance easier: You can customize CoA categories to align with local financial reporting standards.

- It makes for a smoother working relationship with your accountant or bookkeeper. They won’t need to ask you to dig into your books for information when it’s all laid out in detail in your CoA (and it can save you some billable hours as well).

Example:

When you started your business, you didn’t have many advertising costs, so they were all grouped into the Advertising account within Expenses. Now, you advertise through radio, online ads, and direct mail. You can create sub-accounts under the parent account Advertising for each medium to track the cost of each type of advertising.

Now that you’ve broken out your advertising costs, you can determine your ROI for each medium. And when it comes time to do your taxes, you (or your accountant) can easily record the deductible expenses for each marketing type.

8 Best Practices for Customizing Your Chart of Accounts

So you’ve established your standard chart of accounts, and understand how to add, change, and archive accounts. Great. Now, hit pause.

Here are some essential guidelines to follow when making changes to your CoA:

- Only create a new account if you have a good reason. Usually, it’s that you want to see that line item in your reporting. An example: Your wages paid keep rising, but you are not sure why. You can create a Wages parent account with sub-accounts underneath its departments. Now, you can see which departments contribute to the rising labor cost on your Profit and Loss Report.

- Create a logical hierarchy for your sub-accounts, and don’t go more than 3 levels deep. The first level should always be one of the 5 account types.

- Err on the side of fewer, more general sub-accounts. When you have too many accounts, your Profit and Loss statement (P&L) is hard to read, and it’s challenging to spot trends over multiple categories. Most accounting software allows you to classify expenses by Merchant, Client, and Project (or similar), so you can quickly generate reports filtered by these categories. The best practice is to keep your sub-accounts relatively general, then use more detailed reports to drill down to find trends or discrepancies among individual transactions. If you find you need more detail to dig into what’s causing a trend, that’s the time to consider adding sub-accounts.

- Break out your tax-exempt expenses. Expenses you cannot claim on your tax return should have categories separate from deductible expenses, so you don’t have to review expenses line by line at tax time.

- Consider account names. FreshBooks bases default expense categories on IRS and CRA naming conventions. You don’t have to follow those conventions, but it may be helpful when preparing tax returns.

- Avoid deleting or archiving accounts in the middle of the year. You can add new accounts at any time, but in some systems, if you delete accounts in the middle of the year, you may end up with errors in your bookkeeping. In FreshBooks, accounts are archived (hidden from your CoA) instead of being deleted so that it won’t derail your bookkeeping. Still, the best practice is to add adjustments instead of removing accounts mid-year.

- Use standard account numbers. A CoA has a specific order and numbering structure. Balance sheet accounts (assets, liabilities, equity) are listed first, followed by the income statement accounts (revenue, expenses). Here is a general guide to organizing the numbered accounts:

Assets 1000s

Liabilities 2000s

Equity 3000s

Revenue 4000s

Expenses (COGS) 5000s

Expenses (Operating Expenses) 6000s

*In FreshBooks, the correct account number is automatically applied when selecting an Account Sub Type. Account numbers can be customized and tailored for your business. - Keep it simple and consistent. At the end of the day, the best CoA is the one that is consistent and makes sense for you. Adding too much detail and breaking accounts into too many sub-accounts can lead to confusion down the road.

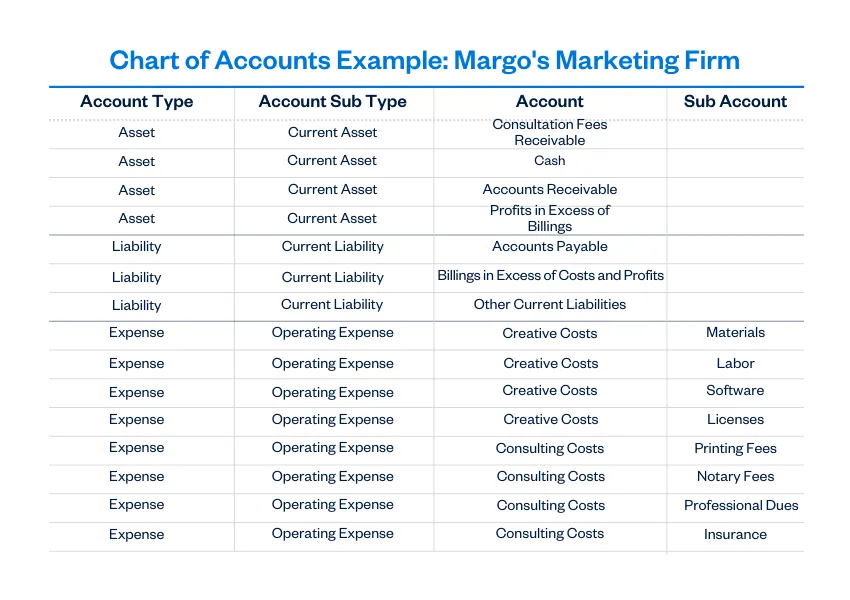

Custom Chart of Accounts Example

The following is a sample chart of accounts for a service-based business. It is not a template but simply an example of how such a CoA might be structured.

Note that business type likely influences a CoA less than ownership structure, business size, payment collection methods and policies, and cash management strategies.

Consider Getting Help From an Accountant or Bookkeeper

Building the right CoA for your business can set you up for success in terms of reporting and tax filing. But it depends on your goals and the reporting you need and want.

Understanding which accounts you need can be complicated, and it’s not always easy to change something later. An accountant or bookkeeper can help you create a customized CoA or rework your existing CoA.

Work with your accounting professional to set up your chart of accounts in a way that makes sense for your day-to-day bookkeeping and for the types of reports (and depth of reporting) you need.

The Easiest Way to Customize Your CoA

You can create your own chart of accounts without using accounting software. But it’s easier to use software that builds a chart of accounts for you.

The FreshBooks chart of accounts is prepopulated with the most common and tax-relevant accounts within all 5 account types so you can start entering transactions immediately. Once you’re ready to customize your CoA, you can select from common sub-accounts and account sub-types or create your own. You can also archive accounts you’ll never need for your business to keep your CoA organized and easier to manage. (You can always un-archive later, and archived transactions still appear on reports.)

Your chart of accounts is an evolving table of contents of your business accounts. It will grow and change along with your business. Once you understand the basic mechanics of a chart of accounts and which financial records you need to manage your business, you can start making your chart of accounts work better for you.

FreshBooks Accounting Specialist Nathan Watmough reviewed and contributed to this post.

about the author

Danny Trinh, CPA, is a FreshBooks Accounting Specialist. He has worked as a financial analyst in the energy industry and as an auditor with the federal government. Once Danny takes off his CPA hat, his free time is mostly consumed by his corgi and finding the next music festival.